september child tax credit payment short

Today I see a pending deposit for October 15 for 389. These individuals may not.

The Last Monthly Child Tax Credit Payments Go Out On Dec 15 The Washington Post

Pin On Finance A Selection Of Credit And Bank Cards Along With A Green British Bad Credit Car Loan Credit Card Management Rewards Credit Cards Psa Didn T Get A Stimulus Payment You Might Need To Do This In 2021 Child Tax Credit Tax Debt Irs.

. We estimated associations between income transfer payments via the EITC and CTC and child maltreatment reports in the period shortly. We are aware of instances where some individuals have not yet received their September payments although they received payments in July and August. After eight days of delay some families said they finally began seeing money for the Sept.

The IRS bases the monthly amount of the child tax credit on 2019 and 2020 tax returns. Its because they dont have a grasp on total eligible recipients. Taking child tax credit payments might be a mistake you have days to fix it.

There are reports however the September payment was short or did not come at all. There are reports however the September payment was short or did not come at all. Your child ages out of eligibility this year.

15 payment of the child tax. The IRS announced earlier that the September batch of payments scheduled for Sept. Last week the IRS successfully delivered a third monthly round of approximately 35 million.

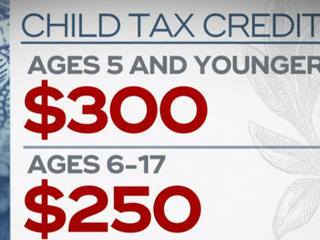

The legislation for the enhanced child tax credit says that the total amount for children under the age of 6 is 3600 with half of the money distributed as advanced payments of 300 per month. But the payments havent been without their glitches. 1064 is an over payment of 214.

The monthly child tax credit payments of 500 along with the pandemic unemployment benefits were helping keep his family of four afloat. About the child tax credit The first half of the credit will be sent as monthly payments of up to 300 for the rest of 2021 and the second half can be claimed when filing 2021 taxes. But youve got a five-year-old and you only received a 300 payment.

The Earned Income Tax Credit EITC and Child Tax Credit CTC are among the largest antipoverty programs in the United States. September 17 2021. In just two weeks many parents will receive their fourth advance child.

The credit is 3600 annually for children under age 6 and 3000 for children ages 6 to 17. The new monthly child tax credit payments the IRS has been sending out since July are up to 300 per eligible child but thats only if your annual income isnt over certain limits. This third batch of advance monthly payments totaling about 15 billion is reaching about 35.

My husbands IRS portal also has 389 pending. Total child tax credit payments between 2021 and 2022 could be up to 3600 per kid. WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families are now receiving their advance Child Tax Credit CTC payment for the month of September.

75000 for an individual taxpayer 150000 for married couples who file their taxes jointly and 112500 for those filing as head of household. The total child tax credit for 2021 is 3600 for each child under 6 and 3000 for each child 6 to 17 years old. This week the IRS successfully delivered a third monthly round of approximately 35 million Child Tax Credits with a total value of about 15 billion.

Should a households income increase or if your child ages out of an eligibility bracket they may be forced to repay the money next year. 15 adds up to about 15 billion. IRSnews IRSnews September 18 2021 The IRS issued about 15 billion in child tax credit payments to about 35 million families this month.

Eligible families who do not opt-out will receive. On September 24 my husband and I married filing joint received 532 EACH totaling 1064. The Internal Revenue Service IRS has made 2021 Advance Child Tax Credit payments since July.

Eligible families who do not opt-out will receive. September 29 2021 951 AM 5 min read. Congress fails to renew the advance Child Tax Credit.

John Belfiore a father of two has not yet received the. Many parents have been spending the money as soon as they get it on things like rent and uniforms and already the payments have helped fewer children go hungry. 778 is an underpayment of 72.

IR-2021-188 September 15 2021. Millions of families across the US will be receiving their third advance child tax credit payment next week on. The next Advanced Child Tax payment is due to go out on October 15th.

September child tax credit payment short Saturday February 19 2022 Edit. Child tax credit money arrives but some parents say IRS shorted them. The last child tax credit check was issued on Sept.

Poverty and low income are associated with increased risk for child maltreatment. The easiest way to avoid having to repay the credit is by opting out which means taxpayers who qualify will get any money due as one. Treasury sends the first monthly round of CTC advance payments to families of more than 60 million children.

As a result the IRS released a statement last week about the issue. That glitch affected about 15 of the people who were slated to receive direct deposit payments for the August child tax credit money. Under the American Rescue Plan the maximum child tax credit rose to 3000 from 2000 per child for children over the age of 6 and it rose to 3600 from 2000 for children under the age of 6.

Parents can get up to 300 per month per kids under. The credit is 3600 annually for children under age 6 and 3000 for children ages 6 to 17. WJW While some parents didnt receive the September child tax credit payment because of a glitch in the system last month.

The IRS sent out the third child tax credit payments on Wednesday Sept. Up until late Friday the IRS had been notably silent about the complaints.

Child Tax Credit 2021 What To Do If You Didn T Get A Payment Or Got The Wrong Amount Cbs News

Child Tax Credit Here S Why Your Payment Is Lower Than You Expected The Washington Post

Child Tax Credit Delayed How To Track Your November Payment Marca

Will Monthly Child Tax Credit Payments Be Renewed Forbes Advisor

Child Tax Credit 2021 What To Do If You Didn T Get A Payment Or Got The Wrong Amount Cbs News

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Pin By Why Intro French On The Medieum Side Tax Credits Canadian Film

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

Childcare Choices Vouchers Tax Credits And More Help With Costs Gov Uk Childcare Childcare Costs Preschool Learning

Transparent Business Card Template Business Resume Template Beautiful Business Resume Samples Education Lesson Plans Education Lessons Curriculum Lesson Plans

Ribo Ethics Ce You Need 1 Hour Every Year Ethics Continuing Education Education

Complete Do It Yourself Freelance Taxes Guide Taxes Tax Guide Tax Forms Income Tax

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

Psa Didn T Get A Stimulus Payment You Might Need To Do This In 2021 Child Tax Credit Tax Debt Irs

What To Know About September Child Tax Credit Payments Forbes Advisor

Missing A Child Tax Credit Payment Learn The Common Problems And How To Fix Them Cnet

September Child Tax Credit Payments How To Fix Mistakes Money